Major tax reform was approved by Congress in the Tax Cuts and Jobs Act (TCJA) on December 22, 2017. The IRS is working on implementing this major tax legislation that will affect both individuals and businesses. The IRS will be releasing information and guidance to taxpayers, businesses and the tax community as it becomes available.

Here are some key aspects of the changes:

INDIVIDUALS

- The new tax bill will not affect your 2017 income taxes. Almost all aspects of the new tax laws will not be effective until you file you 2018 taxes.

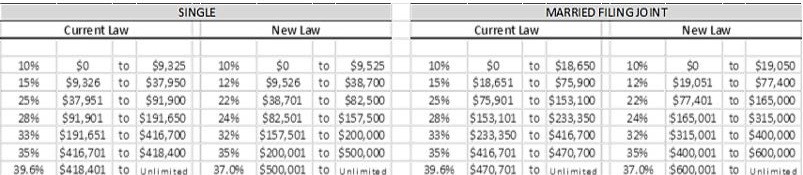

- The new tax bill maintains seven tax brackets but the percentages and income ranges have changed. Here is a comparison of the old and new rates for single and for married filing joint:

- The standard deduction has essentially been doubled. For single filers, the standard deduction has increased from $6,350 to $12,000; for married couples filing jointly, it’s increased from $12,700 to $24,000.

- The personal exemption is gone. Previously, you could claim a $4,050 personal exemption for yourself, your spouse and each of your dependents, which lowered your taxable income. This deduction is now gone.

- The Child Tax Credit has been expanded. The child tax credit has doubled to $2,000 for children under 17. It’s also now available, in full, to more people. The entire credit can be claimed by single parents who make up to $200,000, and married couples who make up to $400,000.

- New tax credit for non-child dependents, like elderly parents. Taxpayers may now claim a $500 temporary credit for non-child dependents. This can apply to a number of people adults support, such as children over age 17, elderly parents or adult children with a disability.

- The mortgage interest deduction has been reduced. Current homeowners are in the clear. But from now on, anyone buying a new home will only be able to deduct the first $750,000 of their mortgage debt. That’s down from $1 million. In addition, interest on home equity loans will no longer be deductible.

- The current deduction for miscellaneous itemized deductions has been repealed. This deduction included items like investment expenses, tax preparation fees, and unreimbursed employee business expenses which were over 2% of the taxpayer’s AGI. This deduction will no longer be available for 2018 and after.